For various applications, i.e., from cryptocurrencies to risk management, Python has become one of the best programming languages among fintech and financial institutions. Today, we’re going to talk about the use of the Python For Finance sector.

It has become the go-to tool for analysts, researchers, as well as traders because of it’s robust modelling capabilities and simplicity in terms of usage. Python Development Trends will help you to understand this aspect.

Gone are the days when people used to spend the entire day by staring at the computer screen, waiting for the data and working on them manually to optimize their gains in the stock market.

The entire time-consuming process has been made so simple with the help of a high-level programming language called Python.Financial Companies are in a spree to hire python web developers for their businesses.

Most of the financial companies and banks are completely dependent on Python and it is now gradually overtaking Java. This article is a detailed guide designed by our Industry Experts who have real-time experience on working with Python and have built robust FinTech Solutions for the clients. We will discuss the best reasons to use Python for Finance.

Why Choose Python for Finance & Technology(FINTECH) ?

Python has been successfully used by many recognized companies.

As per the report published by HackerRank 2018 Developer, Python is ranked under the top three most sought after programming languages in the financial sector.

Following are the various features which make everyone using Python in Finance:

Simple and Flexible

Python is extremely easy to write and install which makes it a perfect programming language to handle the complex financial services application.

The most important component of Python is its syntax which is manageable and proficient to play around the numbers.

Not only this but it also helps in enhancing the development speed and further helps the companies to develop the software they need to introduce to the market.

Additionally, it helps to reduce the error rate at the time of designing the products for a complex industry like finance.

Allows Fast MVP Creation

Needless to say, the financial sector should always be alert and responsive towards the demands of the customers and provide a customized experience which can add value.

This is the reason financial companies and fintechs require a high-end technology which is scalable and flexible and that is exactly what Python offers.

Python For Finance is always the best combination. Using Python with Django will allow the developers to get an idea off the spot and create a solid MVP to find a product.

Once the MVP is validated, the organisations can instantly change some parts of the code. They can also add new code for creating a flawless product.

One of the best examples of the MVP approach is Clearminds platform which was designed with Python as well as Django. They offer investment tools and financial services.

Bridges in Economics & Data Science

Python always comes to the rescue in terms of its simplicity and practicality to create formulas and algorithms. It makes the work of the financial analysts much easier.

Various financial tools like matplotlib, NumPy or SciPy help the person to do complex calculations and finally display the answer in an approachable way.

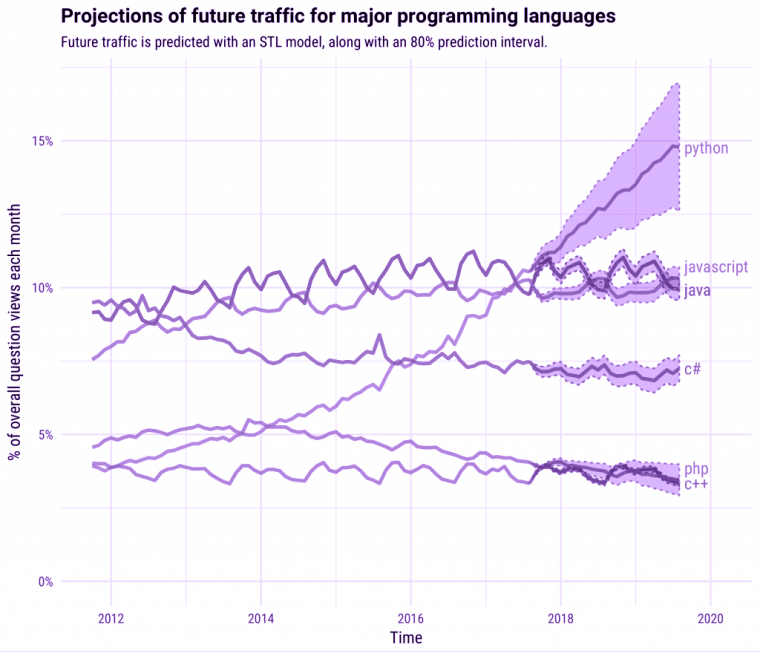

Incredible Growth of Python

Python is used by a wide community consisting of passionate developers who develop practical tools, contribute to open source projects, and organize events in sharing knowledge about the practices of Python development.

When it comes to open source projects, most of the Python frameworks are controlled by the open-source community and is possible to help with the development of Flask, Django, Open CV, and lots more.

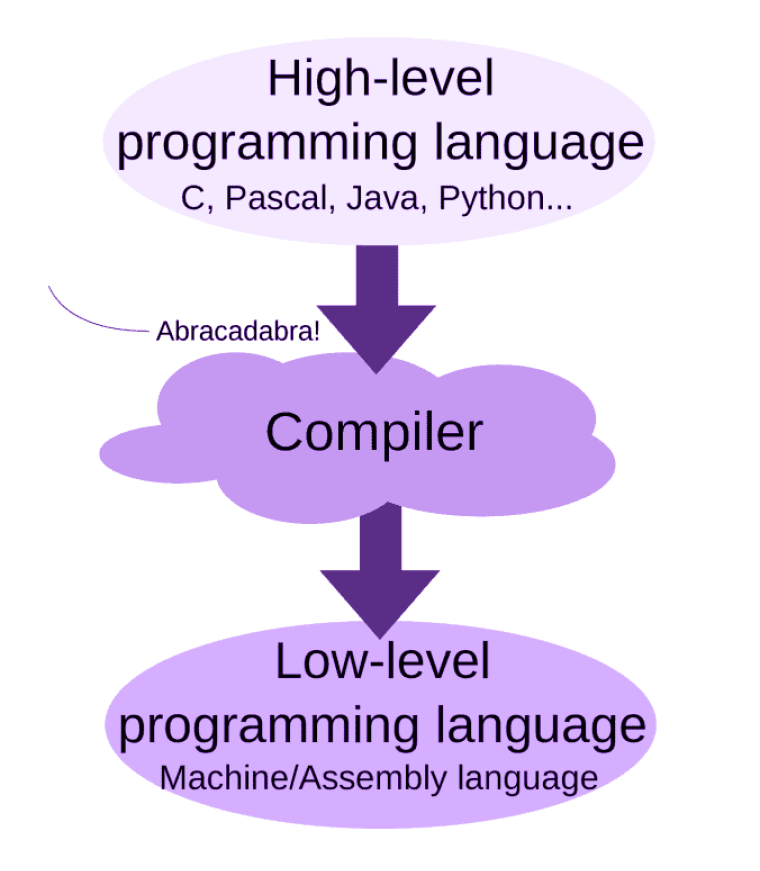

High-level programming language

A high-level programming language summarizes the details of the inner operations of the system. Python is the high-level programming language that abstracts away and then manages many such details automatically by allowing the users to focus on what they want to achieve.

Concise Python code

The Python code is very crisp and is business-specific that the Python development Company wants to attain instead of technical implementation details. It doesn’t require curly braces, semicolons, or lines which many other programming languages do which makes it more concise.

Easy to understand

One of the notable observations which have impacted language design choices in Python is that programs are read more often as compared to they are written.

The code of Python looks similar to plain English particularly if the programmer names various components of the program or script in a sensible way.

Suitable for rapid development

Python is appropriate for prototyping and rapid development as various interactive interpreter tools like the Python shell, IPython as well as Jupyter are located in the front and centre in the Python toolchain.

So in such a situation, the developer can design as well as perform the code in isolation and can see the output.

Suitable for Prototyping & Production

Python is a wonderful tool for large production applications when it comes to Prototyping. Most of the reputed software companies use Python in lots of applications and use cases.

Comes with batteries included

Python standard library consists of needful tools suitable for working with media, files, networking, time information, date, and lots more. This immensely helps in completing the tasks without having to depend on third-party packages.

Free of cost

The high-level programming language is developed under the open-source license which makes it free for any commercial use. So, why not use Python For Finance, isn’t it?

Less Required Code

Python provides less required code and quicker deployment which lets companies to market their products in a much faster way without having to dig into expensive resources.

Loved by Big Banks

Most of the reputed banks like Bank of America switched to Python Quartz, the trading and risk management platform.

Now they are regularly hiring Python engineers along with CitiGroup and Goldman Sachs which look for similar skill sets. Using Python in Finance has become very essential these days.

Suitable for start-ups

Start-ups which are planning a product development process should keep many factors in their mind when it comes to choosing the right programming language.

Being working on a limited budget, they must consider some factors such as the popularity of the language, the speed of development, libraries, cost of developers, security, integrations, stability, and scalability.

These are the reasons that most of the start-ups go for an established and robust technology which is none other than Python.

Greater Collaboration

Python consists of simple composition which helps developers to work together on various projects with professionals like analysts, quantitative researchers, data engineers, and CEO.

Since the technologists boost their exposure to the financial side of the organization and vice versa, Python will gain its popularity.

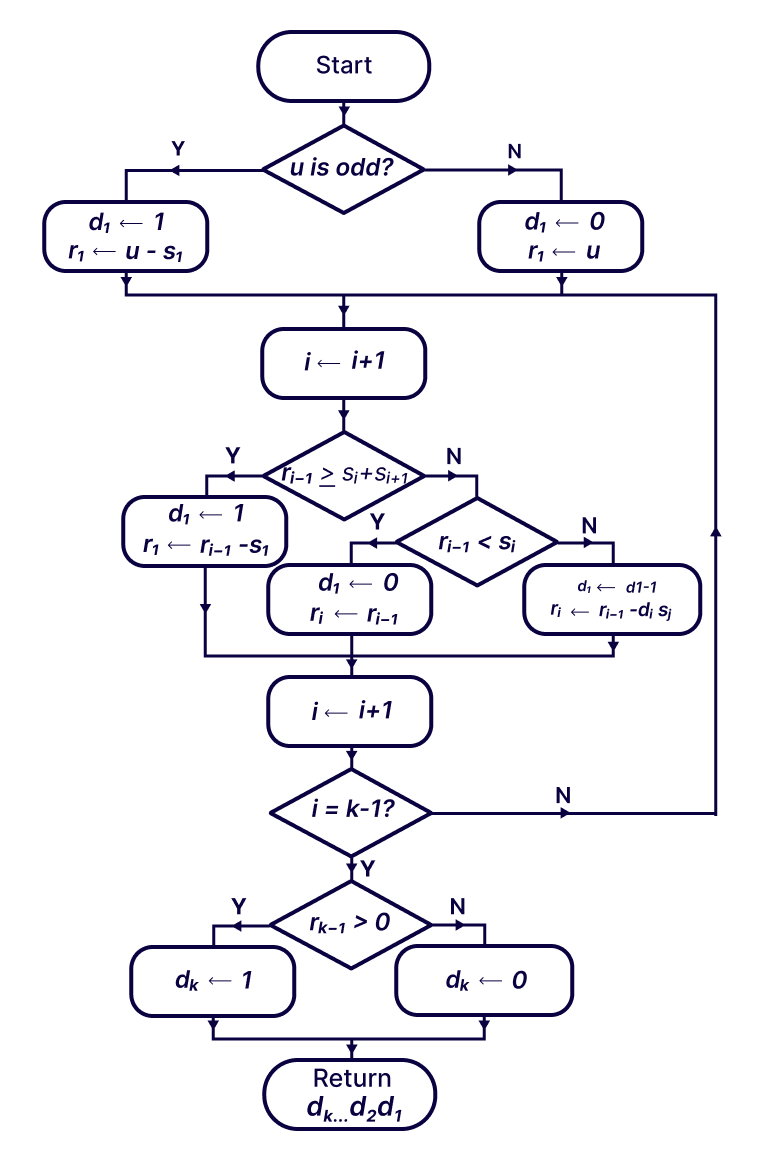

Working with Algorithm

Before understanding how Python is used in Finance, you need to pay attention to various technical challenges such as the algorithmic problem and why Python helps the developers in solving it easily.

The algorithmic problem is the first and foremost challenge developers face while developing a Fintech application.

As Fintech software is associated with many calculations, figures, etc, so the software should be efficient enough to work with such a huge number of mathematical calculations. This is the reason why Python is being chosen by FinTech.

Conversion In Python

When it comes to calculating high-level mathematical equations and other tasks, Python helps the developers in converting any algorithmic or mathematical statement to a single line of Python code.

Vectorization

For instance, a company intends to order the development of financial software that will require the mathematical function to help its customers optimize various financial processes.

For implementing it, the developers can use vectorization features which can be achieved with NumPy – Python open-source library for performing mathematical calculations and supporting high-level math functions.

This function helps the developers in performing around 50,000 calculations with a single code and fasten the development process.

High Performance in Python

Python is featured with a wide range of auxiliary libraries which can enhance the process of interaction with math calculations.

Now the work of the developers is choosing the correct Python library to use it in the financial app development that can ultimately offer high-performance FinTech software to its users.

FinTech apps which are developed in Python operate much faster as compared to those which are written in other languages.

Quick Compilation Libraries

Corresponding Python libraries like Numba or Cython offer developers with functions which can compile Python code into machine code both dynamically and statistically.

Through this, it’s processing speed becomes comparatively faster and the software development becomes easier.

Step-by-Step Guide to Using Python & Finance Together

Technology plays a vital role in finance as most of the financial companies are now transforming into technology companies rather than being occupied with only the financial aspect.

The purpose of this tutorial is giving the finance professionals who are new to Python a basic idea about it and an introduction to the iterative process of Python and Finance.

Developing a Working Prototype

Setting up the Jupyter Notebook

The Jupyter Notebook is a great tool to work with Python collectively. It is a collective Python interpreter which contains code, Markdown text, image, and other data.

In this guide, we have used the Python Quant Platform. Once you visit the platform, just click on the “File” menu and choose “New Python 3 Notebook” and you are ready to proceed further.

Once you are done, the second step is to import the third-party package we want for manipulation as well as data visualization and ask the system we need to see the charts inline in the notebook.

import numpy as np import pandas as pd import matplotlib.pyplot as plt %matplotlib inline

An important point before naming the first variables is that readability is the strength of Python. Language design goes hand in hand with readability.

Creating Financial Statements

There are various methods to work with spreadsheet data in Python. For instance, one can go through a sheet in a Pandas DataFrame with one-liner code with the help of the read.excel command.

But if you need a real-time connection and a stronger integration between your spreadsheet and the Python code, then you can get both free and paid options that are present in the market which offer you that functionality.

The concept which we have used is basic and focused on the concepts of Python. We will recreate it from scratch in the script. At the end of this part, we will display the process of rendering the output into the spreadsheet.

It requires a specific data structure to design a Python representation of the financial statement. So from the Pandas library, we will be using a series to view its functionality as of now.

years = ['2018A', '2019B', '2020P', '2021P', '2022P', '2023P'] sales = pd.Series(index=years) sales['2018A'] = 31.0 sales

Following are the inputs as well as its corresponding output:

With the help of first three lines, we have a data structure along with an index which contains years (each of them marked to show if it is actual, projected, or budget), a starting value (in millions of euros) and empty (“Not a Number” or NaN) cells for projection purposes.

The fourth line shows a representation of the data- in general, which types the name of the variable or other object in the interactive interpreter that will provide you with a sensible representation in it.

Then we will declare a variable for representing the projected annual sales growth.

Here we will use those inputs and confirm that the Python version performs the same way and provides the same result as the Excel version just before looking at replacing point estimates along with probability distributions.

With the help of this variable, we will create a loop which will calculate the sales in the each and every year of the projections depending on the growth rate of the previous year:

growth_rate = 0.1

for year in range(1, 6):

sales[year] = sales[year - 1] * (1 +

growth_rate)

sales

Now we have projected sales rather than NaN:

We will use the same approach to proceed further with the financial statement by declaring a variable that we need them and perform the required calculations to eventually arrive at free cash flow.

Once we proceed there, we will be able to check what we have corresponding to what the Excel version of the DCF model states:

ebitda_margin = 0.14 depr_percent = 0.032 ebitda = sales * ebitda_margin depreciation = sales * depr_percent ebit = ebitda - depreciation nwc_percent = 0.24 nwc = sales * nwc_percent change_in_nwc = nwc.shift(1) - nwc capex_percent = depr_percent capex = -(sales * capex_percent) tax_rate = 0.25 tax_payment = -ebit * tax_rate tax_payment = tax_payment.apply(lambda x: min(x, 0)) free_cash_flow = ebit + depreciation + tax_payment + capex + change_in_nwcfree_cash_flow free_cash_flow

This provides us with the free cash flows:

The one line above that requires a comment at this stage is the second tax_payment reference. Now we will perform a small function for ensuring that in such a situation where profit becomes negative before tax, we will not have any positive tax payment.

This shows how we can apply custom functions to all the cells in a DataFrame or Pandas Series. But the actual function that we will apply is the simplification.

Performing the DCF Valuation

After arriving at projected cash flows, we can calculate a simple terminal value as well as discount all cash flow back to the normal for getting the DCF result.

Now we will access elements by writing square brackets just after the name of the structure. The simple indexing will help in accessing elements by their position,starting with zero which means free_cash_flow[1] will provide us with the second element. [-1] is a shorthand to access the last element and to use a colon that gives us a slice.

cost_of_capital = 0.12

terminal_growth = 0.02

terminal_value = ((free_cash_flow[-1] * (1 +

terminal_growth)) /

(cost_of_capital - terminal_growth))

discount_factors = [(1 / (1 +

cost_of_capital)) ** i for i in range (1,6)]

dcf_value = (sum(free_cash_flow[1:] *

discount_factors) +

terminal_value *

discount_factors[-1])

dcf_value

Exporting the Data

If you have a Pandas DataFrame object, you can write that to an Excel file in a single line by using the to_excel method. There is a similar function for exporting to multiple formats as well as destinations. Understanding the Python Financial Modeling is a key to success.

output = pd.DataFrame([sales, ebit,

free_cash_flow],

index=['Sales', 'EBIT',

'Free Cash Flow']).round(1)

output.to_excel('Python DCF Model

Output.xlsx')

output

Creating Probability Distributions

Now we will decide how many iterations we need for running in the simulation. Using 1,000 as the starting point strikes a balance between getting enough data points to get sensible output plots, versus having the simulation finish within a given time frame.

Our next step would be to generate the actual distributions. Finally, after deciding which distribution we should use, we have to specify the parameters needed for describing their shape like mean and standard deviation as well as the number of desired outcomes.

iterations = 1000 sales_growth_dist = np.random.normal(loc=0.1, scale=0.01, size=iterations) ebitda_margin_dist = np.random.normal(loc=0.14, scale=0.02, size=iterations) nwc_percent_dist = np.random.normal(loc=0.24, scale=0.01, size=iterations) plt.hist(sales_growth_dist, bins=20) plt.show()

Now as we have all the building blocks we have to run the simulation. However, they are not in an appropriate format for running the simulation.

Following is the same code that we have worked with but gathering in a single cell and then assembling happens into a function for convenience:

def run_mcs():

# Create probability distributions

sales_growth_dist =

np.random.normal(loc=0.1, scale=0.01,

size=iterations)

ebitda_margin_dist =

np.random.normal(loc=0.14, scale=0.02,

size=iterations)

nwc_percent_dist =

np.random.normal(loc=0.24, scale=0.01,

size=iterations)

# Calculate DCF value for each set of

random inputs

output_distribution = []

for i in range(iterations):

for year in range(1, 6):

sales[year] = sales[year - 1]

* (1 + sales_growth_dist[0])

ebitda = sales *

ebitda_margin_dist[i]

depreciation = (sales *

depr_percent)

ebit = ebitda - depreciation

nwc = sales * nwc_percent_dist[i]

change_in_nwc = nwc.shift(1) - nwc

capex = -(sales * capex_percent)

tax_payment = -ebit * tax_rate

tax_payment =

tax_payment.apply(lambda x: min(x, 0))

free_cash_flow = ebit +

depreciation + tax_payment + capex +

change_in_nwc

# DCF valuation

terminal_value =

(free_cash_flow[-1] * 1.02) /

(cost_of_capital - 0.02)

free_cash_flow[-1] +=

terminal_value

discount_factors = [(1 / (1 +

cost_of_capital)) ** i for i in range

(1,6)]

dcf_value = sum(free_cash_flow[1:]

* discount_factors )

output_distribution.append(dcf_value)

return output_distribution

We can now operate the entire simulation and plot the output distribution that will be the discounted cash flow value of the particular company in each of the 1,000 iterations with the given code.

The %time command is a notebook shorthand which helps in measuring the time to run something. However, it depends on the system that you operate but this particular version takes 1 to 2 seconds for running the 1,000 iterations and visualizes the output.

%time plt.hist(run_mcs(), bins=20, color='r') plt.show()

Refining the Prototype

Refactoring means the process to rewrite the existing code for improving its structure without changing its functionality. There are various reasons to perform this.

Some of them are:

- Organizing various parts in a sensible manner.

- Renaming the functions and variables in making their purpose and workings clearer.

- Allowing and preparing for future features.

- Boosting the execution speed, memory footprints, and other resource utilization.

To make it more clear, we have cleaned the prototype we just looked at by collecting all the variables in a single place and then optimized its execution speed through vectorization.

# Key inputs from DCF model

years = 5

starting_sales = 31.0

capex_percent = depr_percent = 0.032

sales_growth = 0.1

ebitda_margin = 0.14

nwc_percent = 0.24

tax_rate = 0.25

# DCF assumptions

r = 0.12

g = 0.02

# For MCS model

iterations = 1000

sales_std_dev = 0.01

ebitda_std_dev = 0.02

nwc_std_dev = 0.01

def run_mcs():

# Generate probability distributions

sales_growth_dist =

np.random.normal(loc=sales_growth,

scale=sales_std_dev, size=(years, iterations))

ebitda_margin_dist =

np.random.normal(loc=ebitda_margin,

scale=ebitda_std_dev,

size=(years, iterations))

nwc_percent_dist =

np.random.normal(loc=nwc_percent,

scale=nwc_std_dev,

size=(years, iterations))

# Calculate free cash flow

sales_growth_dist += 1

for i in range(1,

len(sales_growth_dist)):

sales_growth_dist[i] *=

sales_growth_dist[i-1]

sales = sales_growth_dist *

starting_sales

ebitda = sales * ebitda_margin_dist

ebit = ebitda - (sales * depr_percent)

tax = -(ebit * tax_rate)

np.clip(tax, a_min=None, a_max=0)

nwc = nwc_percent_dist * sales

starting_nwc = starting_sales *

nwc_percent

prev_year_nwc = np.roll(nwc, 1, axis=0)

prev_year_nwc[0] = starting_nwc

delta_nwc = prev_year_nwc - nwc

capex = -(sales * capex_percent)

free_cash_flow = ebitda + tax +

delta_nwc + capex

# Discount cash flows to get DCF value

terminal_value = free_cash_flow[-1] * (1

+ g) / (r - g)

discount_rates = [(1 / (1 + r)) ** i for

i in range (1,6)]

dcf_value = sum((free_cash_flow.T *

discount_rates).T)

dcf_value += terminal_value *

discount_rates[-1]

return dcf_value

The main difference between the two versions is there was the absence of the for i in range(iterations) loop in the previous version.

Through the NumPy’s array operation, this particular version operates in 18 milliseconds as compared to the prototype version which takes 1.35 seconds – roughly 75x faster.

%time plt.hist(run_mcs(), bins=20, density=True, color="r") plt.show()

Applications of Python in Finance

Python is widely used in various applications. Following are the popular uses of Python in financial organizations.

Analytics Tool

Python is used in various quantitative finance solutions which process and analyze big financial data and large datasets. Libraries like ‘Pandas’ help to simplify the process of data visualization and carry out advanced statistical calculations.

Banking software

Every financial organization develops payment solutions as well as online banking sites with Python.

Venmo is one such example of a mobile banking platform which has now developed into a full-fledged social network.

The ATM software of the banks is also developed with Python which enhances the payment processing.

Cryptocurrency

The Python data science ecosystem known as Anaconda helps to carry out the market analysis in getting insights and predictions. This is the reason that most of the web apps which deal with cryptocurrency analysis get benefits of Python.

Trading

Stock market acquires huge data which needs detailed analysis and this is where Python In Finance comes to the rescue. Developers make use of it in creating solutions which can identify trading strategies and provide analytical insights into the condition of a particular market.

Financial Companies That Is Using Python

Finance and Python go a long way. Following are some of the well-known fintech companies that apply Python technologies:

Stripe

Stripe helps web-based or e-commerce businesses in receiving payments through its website. The company allows, accepts as well as manages online transactions in real-time.

As its core is a robust payment engine which simplifies the money flow in an organization while connecting with apps that enable you to prevent cyber frauds, manage revenue, and finally drive business growth through Scala, Ruby, and Python tech stack.

Dwolla

Dwolla has specifically been designed for bank transfer.

The platform is extremely flexible and consists of an easy-to-use range of products which operates with all US-based banks and credit unions, developing user-friendly apps which allow to make the bank transfer, manage the customers as well as verify the bank accounts.

The platform allows the users to send, receive, and transfer money whereas the verification takes no time. The engineers developed the platforms by using Javascript, Scala, C#, and Python.

Zopa

Zopa is one of the largest peer to peer companies that has more than 75,000 active investors which has invested more than £3 billion to the borrowers.

It offers a user-friendly interface as well as ISA investment options that appeal to various peer to peer lenders and provides investment products where UK-based customer gets funding who are in search of personal loans.

Zopa uses Python as the key language. Additionally, they use Django, Flask, Pandas, RabbitMQ, Postgres, Celery, etc. So, Python Programming for Finance is great.

Affirm

The goal of Affirm is to deliver accessible and accountable services to its customers. The company offers highly secured payment solutions along with flexible payback terms.

Through this, the customers can save their money and further improve their credit score by paying back their loan on time with no late payment penalties. The software engineers of Affirm use Flask/Python in their tech stack.

Thought Machine

Thought Machine helps to solve the primary problems of the banking industry.

It relies on the outdated IT infrastructure and gives their customers the solutions which they deserve and are in search of. This is the reason Thought Machine has developed Vault OS.

Vault OS is a microservice API architecture platform that uses modern technology like blockchain and cloud infrastructure for creating a banking operating system which helps in maintaining a ledger.

Not only this but the platform also gives a unique experience to the banking industry.

Robinhood

Robinhood is a stock trading application which operates perfectly for ETFs and stocks. The platform has recently provided services for Bitcoin virtual currency.

Robinhood mainly focuses on tracking the stocks that the customers own as well as on their watchlist. To trade, just tap on any stock. Next, enter your trade in the application and own the stock without any trade fees or commission.

The platform also has a premium account which offers its users the access to margin trading as well as extended trading hours along with all other features.

Venmo

Venmo represents social media platforms and also payment service providers in the USA. With the help of Venmo, you can transfer money from one account to another instantly.

The platform not only helps to make payments in the shops and malls but also facilitates easy chat with your friends and family.

Established in 2009, its aim was to share the bill with friends to make payment for meals, movies or taxi.

Presently, it provides a full payment system with social media capabilities. This is the reason that the company uses Python for its application development.

Stockspot

Do you know why Python is being widely used by the fintech companies? It’s because Python consists of certain features such as better scalability, simple coding as well as the powerful list of frameworks. One of such fintech companies which efficiently used Python is Stockspot.

The company uses Django and Python, ReactJS for their front end and back end development. Stockspot offers wealth management solutions to its customers and simplifies all the issues regarding the investment portfolio.

Read also: Python vs C++: Which Is The Best Programming Language?

Python Libraries For Fintech

Fintech has covered various domains such as e-banking, insurance, regulations, lending, trading, and various other payment services and hence has a wider scope.

Most of the Fintech startups have started employing Python and its frameworks for their front end and back end development.

Apart from this, hedge fund industries and investment banking are also using Python in solving all the quantitative issues for trade management, pricing, as well as risk management platforms.

So following are some of the open-source Python libraries that assist the Fintech industry:

PyAlgoTrade

PyAlgoTrade is basically an event-driven algorithmic trading Python library that supports live-feed paper trading, backtesting, and real-time trading on Bitstamp.

The platform takes its design on Python 2.7/3.7 and its dependencies consist of SciPy and NumPy, pytz, matplotlib to plot support, tweepy for Twitter support, and tornado for Bitstamp support.

How To Install:

pip install pyalgotrade

Here we will see how the data series abstractions are made by using PyAlgoTrade:

class pyalgotrade.dataseries.SequenceDataSeries(maxLen=None)

Pyfolio

How To Install:

pip install pyfolio import pyfolio as pf

Pyfolio mainly deals with performance and risk analytics regarding financial portfolios. The platform was developed and is operated by Quantopian in the year 2015.

Pyfolio works fine with Zipline, a Pythonic algorithmic trading library. Pyfolio open-source library is to model tear sheets that are based on returns.

There are many other features such as to plot tear sheets with pyfolio plotting as well as pyfolio time-series to call individual statistical functions.

# THIS FETCHES APPLE STOCKS #

stock_rets = pf.utils.get_symbol_rets('AAPL')

Zipline

Zipline is an open-source algorithmic trading simulator that uses Python. It is an event-driven system used for backtesting. Quantopian develops and updates Zipline and offers an easy to use web interface.

QuantLib

Lots of finance professionals work in valuation and structuring. Thankfully there is a Python wrap version for them which helps in valuing and calculating the risk of financial derivatives. As it has C++ at its core, it is fast in terms of processing.

As QuantLib is not a native Python library and there is no particular documentation, there is a steep learning curve to make it work out.

SciPy

SciPy consists of a wide variety of functions that are necessary to work with financial operations, covering techniques like signal processing, linear algebra, optimization, and interpolation.

NumPy

The NumPy helps the users in manipulating matrices and arrays and implementing such functions for a random number generation that is important for specific optimization techniques like bagging and boosting.

Real-World Applications of Python

Web Applications and Frameworks

Most of us use web applications these days to make online purchases, web browsing, or making online transactions. Do you know that most of the web applications are powered by Python?

Google search engine is partly designed by Python. On the other hand, a complex framework like ERP5 that is an enterprise resource planning system used in banking, finance, and aerospace industries is also completely powered by Python.

Business Enterprises

Nowadays popular enterprises use Python to support their products and services. One of the well-known examples of Python used by billions of users per day is YouTube.

Google-owned video-sharing platform is featured with lots of functionalities which has been designed only by using Python.

Another popular example of a social sharing platform designed by Python is Reddit. The platform has adopted Python in the year 2005.

Experimentation/Building Prototypes

Python is a free programming language and hence used for various experiments. The general-purpose programming language is being used to build prototypes and rough applications.

The main benefit of Python is that one can customize the prototypes to offer a profitable user experience.

Conclusion

Python is an ideal technology to build banking as well as financial apps. Python is such a programming language that offers lots of benefits such as greater development strategies, clear programming syntax, and many more.

It is also user-friendly and that’s the main reason that most of the banking app developers prefer it. So what are you waiting for?

Switch to Python by hiring a Python developer from the well known Python development companies like esparkBiz. Our experts will help you by keeping in mind all your needs with expert software testing solutions.