The rapid development of the financial technology industry, for the last few years, has witnessed technological advancements with remarkable speed, security, and good user experience simultaneously. One of the significant components of flexible design in ReactJS is the virtual DOM, which is appropriate for constructing rich and scalable fintech applications such as progressive web applications.

ReactJS enables fintech companies with real-time updates to intuitive data visualizations to deliver secure, user-friendly experiences that meet the high demands of today’s digital finance landscape.

Understanding the Role of ReactJS in the Fintech Industry

- Popular Fintech apps can incorporate real-time updates and high app user control. These features can be built using ReactJS developer tools.

- The presence of Virtual DOM within the React framework also helps in overcoming various rendering problems in Fintech applications that have been posed previously.

- ReactJS also goes a long way in simplifying extremely complex processes especially when dealing with financial dashboards and complex analytics.

- A unique feature of ReactJS component-based architecture is that the ReactJS developers can create reusable UI elements, thus contributing to the efficient design of an application.

Advantages of Implementing ReactJS in Fintech

When it comes to the development of applications from the financial technology standpoint, it is highlighted that ReactJS has a lot of proven benefits. – let us discuss these benefits in more detail:

| Benefit | Description | Importance in Fintech |

| High Performance and Speed | Adopts a virtual DOM that promotes fast rendering and ultra-fast loading of pages. | Ensures that the business transactions undertaking and its current changes can operate in the live mode, especially in providing global funds transfer services. |

| Scalability and Reusability | This architectural style allows for the creation of reusable code and designs. These reusable components can be used for a long time. | Speeds up the feature development process to keep up with current trends in fintech. |

| Enhanced User Experience (UX) | Interactive designs help simplify complex concepts into graphical representations. Hence it is user-friendly. | Enhance subscriber usage through effective and simple infographics with an engaging and pleasing interface. |

| Advanced State Management Options | Makes effective use of Hooks, the Context API, and Redux in the management of the application state and side effects as a whole. | Ensures data coherence with efficient state management for complex fintech apps. |

Check out a Quick Tutorial on building a ReactJS Fintech App with Stunning UX:

Safety and Regulatory Considerations in Fintech Development Using ReactJS

Data security and control have always been two important elements within any financial services and technology. Let us review ReactJS as an effective tool that supports safety and compliance in financial technologies:

| Aspect | Description | Importance in Fintech |

| Data Security | One must ensure strict compliance with the standard management security practices of the industry, and that any sensitive information is protected in every possible way. | This is extremely critical in order to protect the end user of such banking apps who is likely to be engaged in any financial transactions. |

| Compliance-Friendly Development | The Fintech companies ensure compliance with all prevailing industry restrictions and standards in all their undertakings, especially with regard to PCI-DSS and GDPR. | As long as the business complies with the laws and customs of the society within which it operates, it will avoid any situation and any security risks that may arise from operating a business. |

| Role-Based Access Control | Facilitates access management based on previously defined roles and responsibilities for access. This is done in order to shield confidential information from any unwarranted interference. | The information is accessible only to those who have been granted permission, thus increasing the security level further. |

| Encryption Compatibility | The protection of information is fortified by the use of encryption storage systems in a dynamic manner while accessing or even storing the data. | So far as finance technology applications are concerned, protecting data from security vulnerabilities requires confidentiality as well as data integrity. |

The Flexible Architecture of React readily accommodates all these advanced security measures with the regulatory requirements of finance technology. It even has encryption support that enables it to transfer and store any data safely—which is the primary function of online banking apps.

Insights: 91% of consumers claim that seamless digital experiences shape their selection of digital banking options, thus making high-performance, user-friendly applications irreplaceable.

Advanced ReactJS Features that Benefit Fintech

Fintech apps being multi-dimensional, the ReactJS provides features like Hooks, Context API, and redux which make state management easier, support real-time updates, and therefore ensure that they do not compromise user experience.

| Feature | Description | Importance in Fintech |

| React Hooks | Provides useState, useEffect, and personalized hooks to make handling state and side effects easier. | Can operate the code proficiently to execute modifications and perform operations in quicker fintech apps. |

| Context API | Easily supervises the state of the application at a global level, thus eliminating the need for prop drilling. | Provides a mechanism to ensure consistency of user data across different components for a seamless experience. |

| Redux | Provides a consistent state management paradigm that is suited for the intensive care of complicated web apps. | Suitable for dealing with high-frequency data streams and publishing updates back to web and mobile applications channels often within a matter of seconds, for example, in financial services applications. |

| Memoization (useMemo) | Implements a cache for the computations-heavy methods to boost the speed of performance and reduce re-renders. | An increase in the performance of an application is achievable; hence dealing with larger sets of data becomes easier. |

| Lazy Loading and Code Splitting | Initially fetches and loads only the essential elements to improve the loading speeds. | This will ensure better performance, which is particularly important in those fintech apps where users will expect the data immediately available. |

It is these characteristics that will guarantee that ReactJS will be used at maximum speed and ability to grow that fintech apps do specifically for processing large data sets and enabling real-time interaction between the user and the React-built applications.

Step-by-Step Guide on Fintech App Development Using ReactJS

Implementing a fintech App using ReactJS entails a sequential procedure that is structured in a way that maximizes efficiency, security, and respect for the applicable jurisdictional laws.

Step 1: Identify the Objectives of the Fintech Application

It’s All About Recognizing the Goals of the Users and Compliance Requirements – The very first one is all about recognizing the main purpose users have as well as how it complies with all the necessary regulations such as PCI-DSS or GDPR.

Key Characteristics and Functions: Consider first the primary elements such as user accounts, transaction history, live updates, etc., and the additional features that may be needed for each element.

Step 2: An Interface Design Based on User Requirements Using ReactJS

UI/UX in Fintech Applications: This should allow timely interaction where the users need it as they are already accustomed to given the latest ReactJS trends for building interactive applications.

React’s Components Library: When it comes to interfaces that are capable of attracting users, this is true predominantly due to the existence of many component libraries present in React.

Consult with the Reputed ReactJS Development Company who can fulfill your Finance App objectives as well as provide with Fintech solutions that leads you ahead in the competitive market.

Step 3: Integration of Secure Data Handling

Seamless API: ReactJS has integrated layers of APIs to facilitate easy and safe transfer of sensitive information especially when dealing with a financial transaction.

Path To A Clean(er) React Architecture – API Layer & Fetch Functions

✍ @profydevhttps://t.co/ZUmbwAYpDQ

— React Geek (@react_geek) November 25, 2024

Protection by Encryption and Secured Storage: Such Fintech organizations need to possess sophisticated levels of encryption as well as storage capabilities where sensitive details concerning their clients are safely kept.

Step 4: Testing and Optimizing Performance

Comprehensive Testing for Fintech: Ensure extensive testing so that your app is secure, operates optimally, and adheres to the highest standards.

Lazy Loading and Code Splitting to Enhance Speed Issues. A lot of data is involved in the loading process of fintech apps, hence effective ReactJS performance optimization techniques like lazy loading as well as code splitting are important.

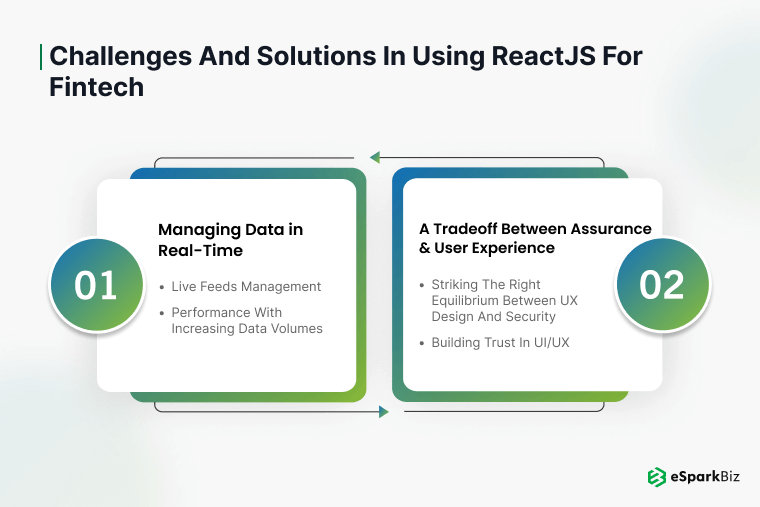

Challenges and Solutions in Using ReactJS for Fintech

At present, the use of real-time data is undoubtedly the biggest constraint to the adoption of Fintech through ReactJS.

Managing Data in Real-Time

Live feeds management: Optimize smart data management system to facilitate continuous updating of high-frequency data feeds without performance degradation.

Performance with Increasing Data Volumes: To improve the user interface performance when dealing with large volumes of data, make use of data paging and caching techniques.

A Tradeoff Between Assurance and User Experience

Striking the right equilibrium between UX design and security: Make sure secure user flows are designed in the spirit of easy user experience rather than adding unwelcome views that cause ADHD to users.

Building Trust in UI/UX: Leveraging the ReactJS UI Frameworks help ensure that the UI components are designed in such a way that they are hard to misunderstand as trust can be built rather quickly, especially in cases where different kinds of transactions are highly sensitive in finances.

eSparkBiz Fintech Case Study: Overcoming Key Challenges with ReactJS

Client Overview

A fast and technology-oriented fintech requires at the very least an application that is secure and easy to use. However, it needs also to be dependable enough to cope with the expansion demands that are likely to be real-time in providing financial information. Concerning direct support for scalability in anticipation of additional growth and new features, addressing security concerns were primarily directed toward offering compliance and building resilient systems for end users.

Insights: 72% of users prefer mobile banking application usage underscores the need for real-time, interactive front-end development Framework such as ReactJS.

Challenges

Management of data in real-time: Processing a vast number of fast-moving financial transactions and their related activities and processing them within the constraint of zero time.

Security and compliance concern: At the same time it was necessary to achieve full compliance with two separate regulations – GDPR and PCI-DSS because the client dealt with sensitive financial data and had to protect it.

Inability to leverage Visual Identities: With the vast amounts of financial information, it is necessary to develop visual representations in the form of dashboards, which could be done using flexible and easy-to-use graphics.

Scalability: The proposed architecture turned out to be problematic because the organization is also interested in a visually appealing architecture that would be able to add new functionalities in the long run.

Solutions

Implementing ReactJS for Faster User Engagement: Employ the virtual DOM and the component-based architecture for faster load times & user interaction ultimately delivering enterprise-level application using ReactJS.

Assurance of Safety and Regulatory Compliance of the Information: This guarantees the protection of information and information systems as well as the adherence to laws such as data privacy and payment regulations by use of encryption techniques and role-based access privileges in the management of the state.

Better Display of Financial Information: The performance of financial data is enhanced with the aid of React JS libraries that are used to create visualizations that are attractive, easy to understand, and engage the user.

Architectural arrangement for future growth: Concentrate on the development of reusable React components that are flexible in design and that make possible easy addition of other functionalities.

Outcomes

Improved User Experience: It provides information in real-time and hence, the information or answer offered to a user has to be quite fast. This, in turn, would attract the users.

Ensure Security and Reliability: Compliance with various data regulations such as GDPR and PCI-DSS ensures the protection of sensitive data while protecting the users’ confidence.

The Data Insight fuses interactivity and visualization: Our customers were stunned by the ability to create easy-to-use and interaction design dashboards that improved engagement.

Scalability for Growth: ReactJS offers and delivers an almost perfect business model that is flexible, which is quite good concerning rapid growth and also enables developers to expand easily in the future.

Conclusion

ReactJS- the open-source JavaScript Library, is becoming the ideal technology stack for web applications among the fintech companies which deliver apps that are fast, secure, and user-centered. Its modularity, in-built security measures, and scalability make it very appealing within the fintech zone where issues of trust and compliance are paramount. There is no better option than to hire ReactJS Developers to be at the forefront when it comes to delivering next-generation flexible solutions to businesses as the fintech startups continue to progress.

Why Choose eSparkBiz for ReactJS in Fintech?

Partnering with eSparkBiz will help you realize the potential of your fintech company built on ReactJS. Here’s why:

Proficiency in React JS and Financial Service delivery

Track Record in Fintech: eSparkBiz has remained focused on building quality solutions for FinTech clients without undercutting the quality standards even for a single day.

Tailored Reactive js solutions for safe and resilient applications: These are custom-made to produce secure and scalable applications without any data breaches at any time.

Dedication to Security and Compliance

Potential and Expertise in Compliance in Fintech: Knowledge of the laws that govern the operation of the industry aids in ensuring that every application serves a basic legal and compliance purpose.

Security First Development Approach: We are firm believers in imparting strong security throughout the development processes and adopting the ReactJS best practices in the industry to ensure the data privacy of your application.

-

What are the key advantages of utilizing ReactJS for Fintech applications?

There are various advantages to using ReactJS within the scope of fintech, and some of them that stand out include speed, real-time updates without flickering, and the ability to scale up quite easily.

-

How does ReactJS ensure data security in financial applications?

Given its facilitated secure state management, ReactJS being a popular JavaScript library ensures security in applications that involve users’ financial activities. It uses data encryption and policy-based access control to limit access to sensitive data of the Business.

-

Can ReactJS handle real-time data requirements in Fintech?

React was built with such an architectural foundation and modern state management techniques such as using React with Redux and Hooks that ensure the updates are real-time.

-

What is the difference between Redux and Context API for Fintech apps?

For Context API, it is simpler and more understandable in developing and managing small-scale applications of state but due to the rigidity nature of redux, it becomes less advantageous for a large-scale Fintech project which may have many users interacting with the same application.

-

Why choose eSparkBiz for ReactJS Fintech App development?

eSparkBiz offers years of experience in deliverable fintech projects along with expertise and consulting in the field of React JS development Services pertaining to fintech, therefore providing the best performance-based, secured, and scalable solutions.