Tender Participation and Winning Bid

Unibank successfully won the bid to develop an Android version of their existing iOS-based loyalty card application. This project involved a precise and methodical execution of testing tasks, ensuring the Android version would meet the same high standards as the iOS app. The team demonstrated its capability by thoroughly analyzing the app's features, functionality, and user experience to replicate and improve the application for Android users. The successful execution of this task highlighted the team's expertise in adapting and optimizing applications across platforms, ensuring Unibank’s continued success in the competitive mobile banking space.

In-depth Business Analysis

A detailed business analysis phase, lasting one month, was conducted to define the precise specifications for the new Android application. This analysis aimed to capture every functional and design requirement needed to align the app with Unibank's strategic goals. By closely examining customer needs, industry trends, and technical considerations, the team was able to develop a clear blueprint for the app’s development. This critical phase ensured that all features and functionalities were well thought out, enhancing the app’s relevance and usability for end-users while staying aligned with the bank’s long-term objectives.

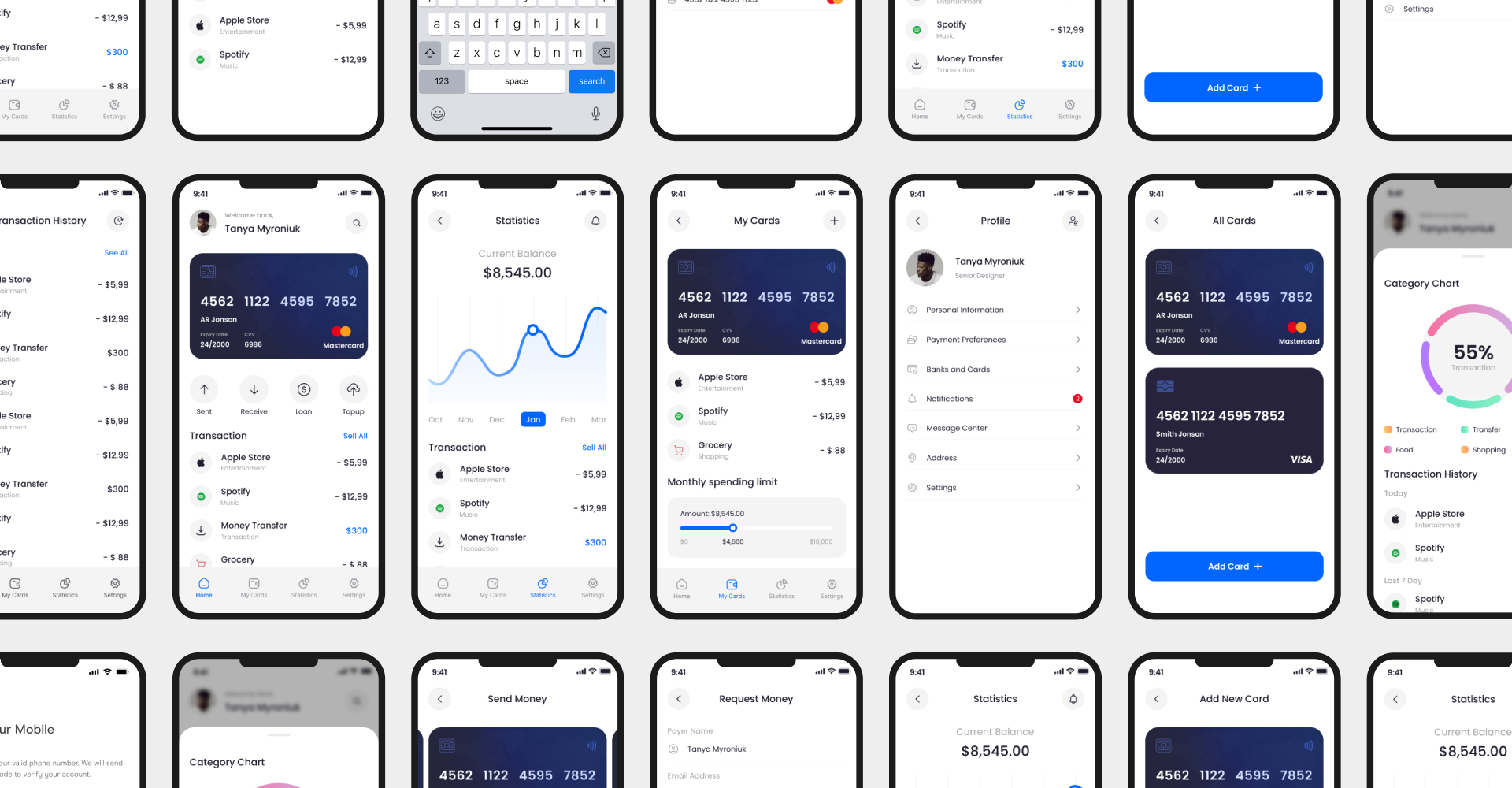

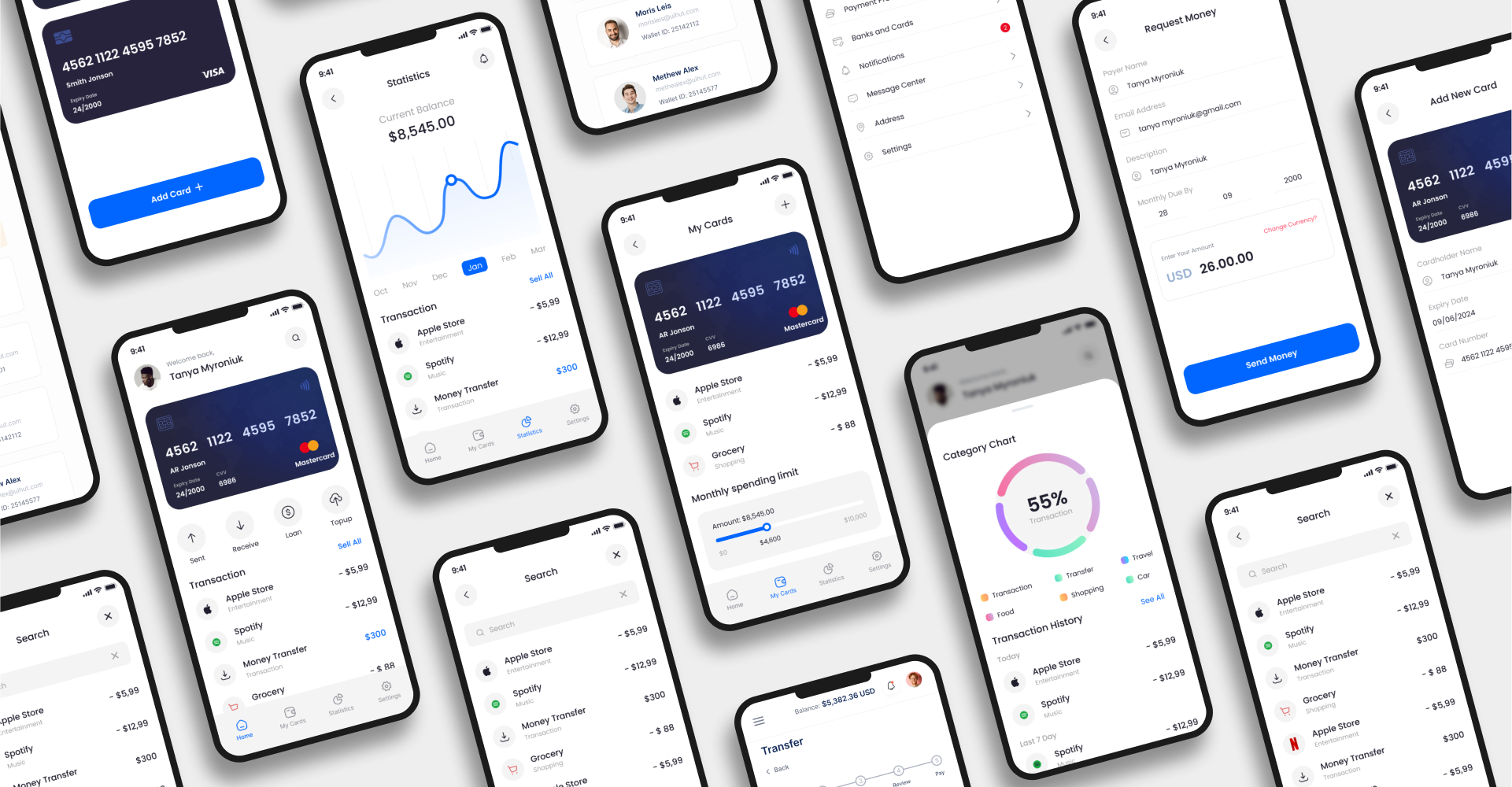

Intuitive UI/UX Design

The mobile applications were designed with a strong focus on intuitive and user-centric interfaces, ensuring an engaging and efficient banking experience. The design process prioritized simplicity, accessibility, and ease of use to meet the diverse needs of Unibank’s customer base. Every element of the user interface was carefully crafted to be visually appealing while also enhancing the functionality of the app. By focusing on both aesthetics and practicality, the application’s design ensured users could navigate through banking services effortlessly, contributing to an elevated customer experience.

Full-Scale Application Development

A comprehensive development process was undertaken to create robust mobile applications for both iOS and Android platforms. The development covered all aspects of the app, from backend functionality to frontend user interaction, ensuring high performance, security, and scalability. The apps were equipped with a variety of advanced features designed specifically for the banking sector, such as secure money transfers, loan management, and bill payments. By addressing every element of the mobile banking experience, the project provided customers with a complete, seamless, and reliable solution for managing their finances.

Key Functional Features

The app offers comprehensive Account Management, allowing users to effortlessly view their balance and access detailed bank statements for efficient account tracking. Payment Services include seamless BillPay, one-click payments, and auto-payment scheduling, streamlining transactions. For Money Transfers, the app enables hassle-free card-to-card and account-to-account transfers. Loan Management simplifies online loan repayments and deposit top-ups. Currency Tools provide real-time exchange rates and a multicurrency converter for managing finances across currencies. Push Notifications keep users updated on important news, while Support Features offer chat and phone assistance for a smoother experience.